×

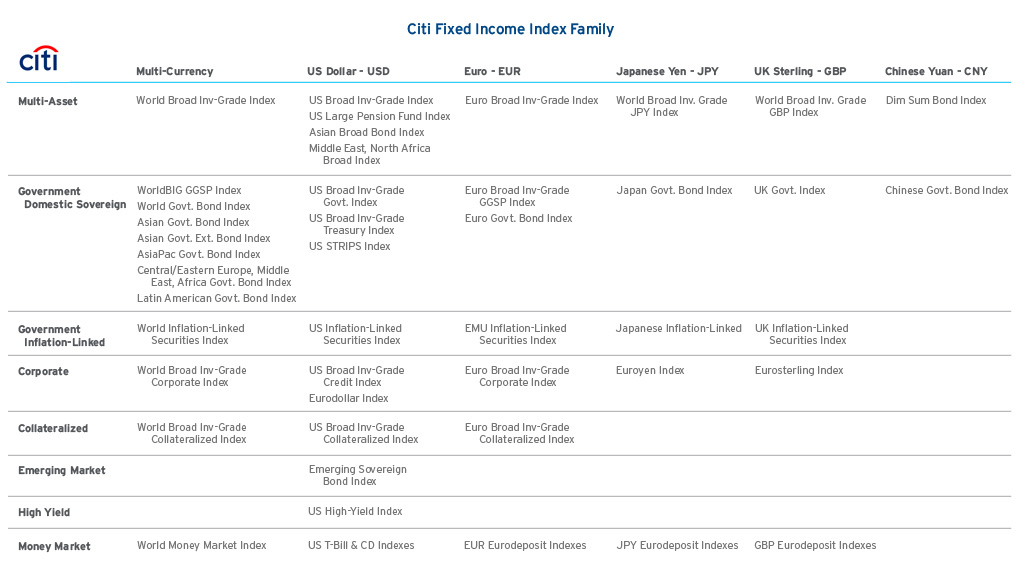

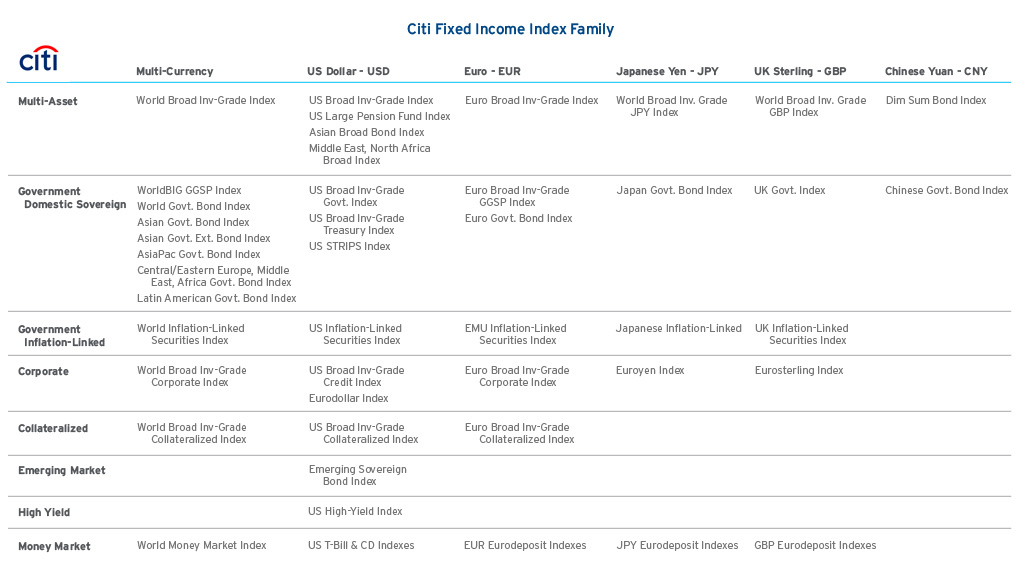

Our Index Family

×

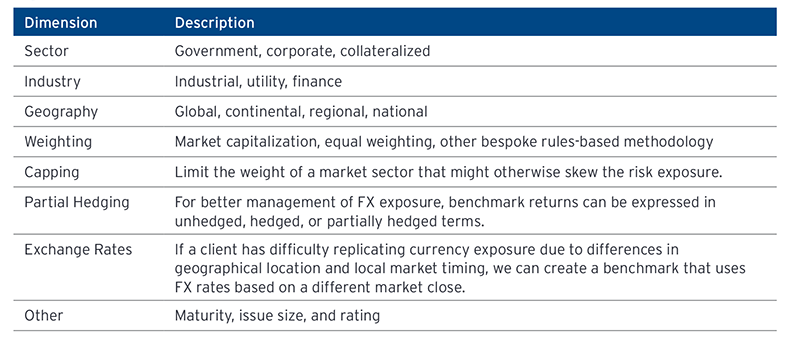

Customization Capabilities

×

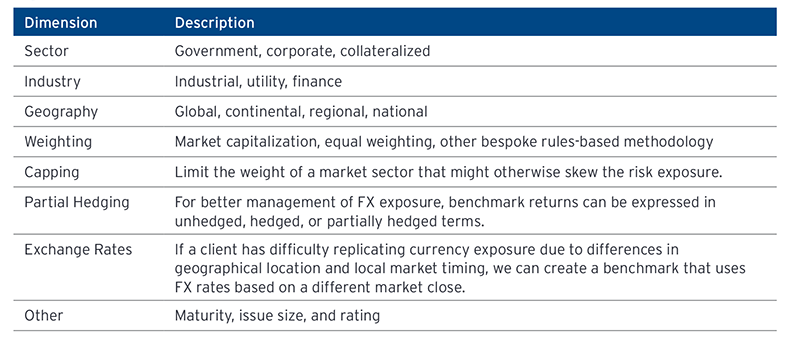

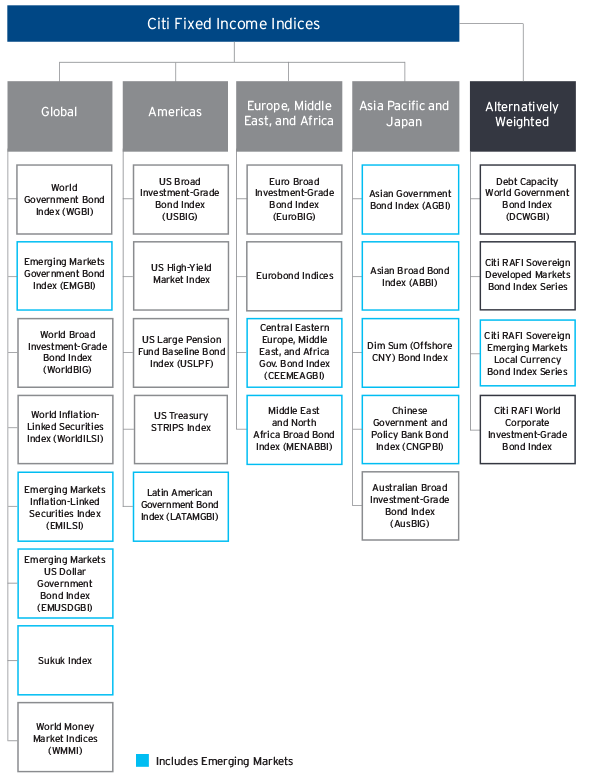

Citi Fixed Income Indices Family Tree

×

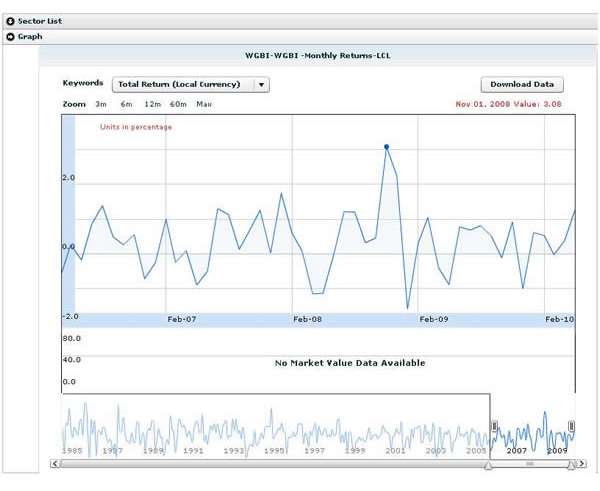

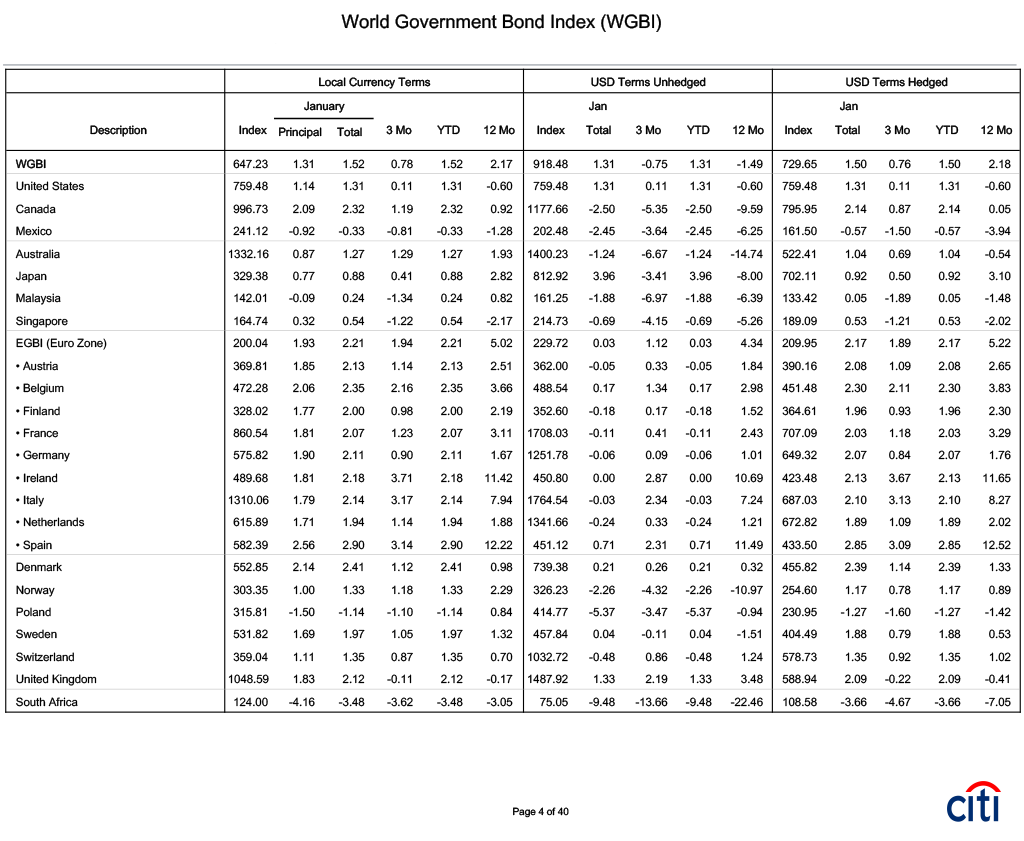

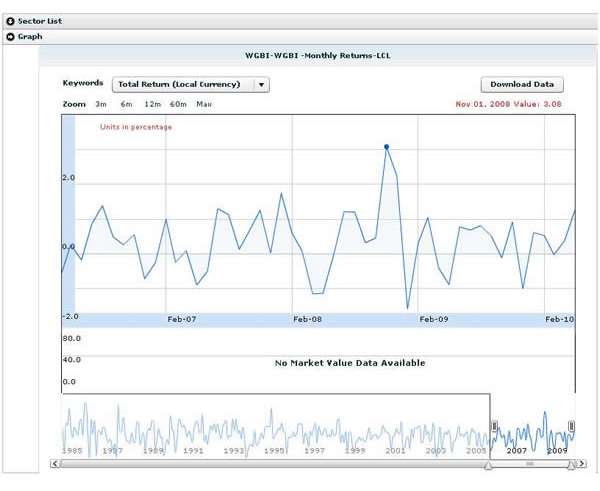

WGBI Monthly Returns

×

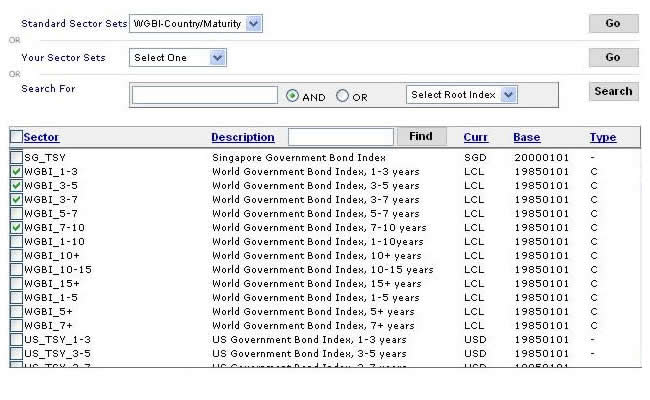

Index Custom Report

×

Yield Book - Return Attribution Summary

×

Citi Fixed Income Indices on Citi Velocity

×

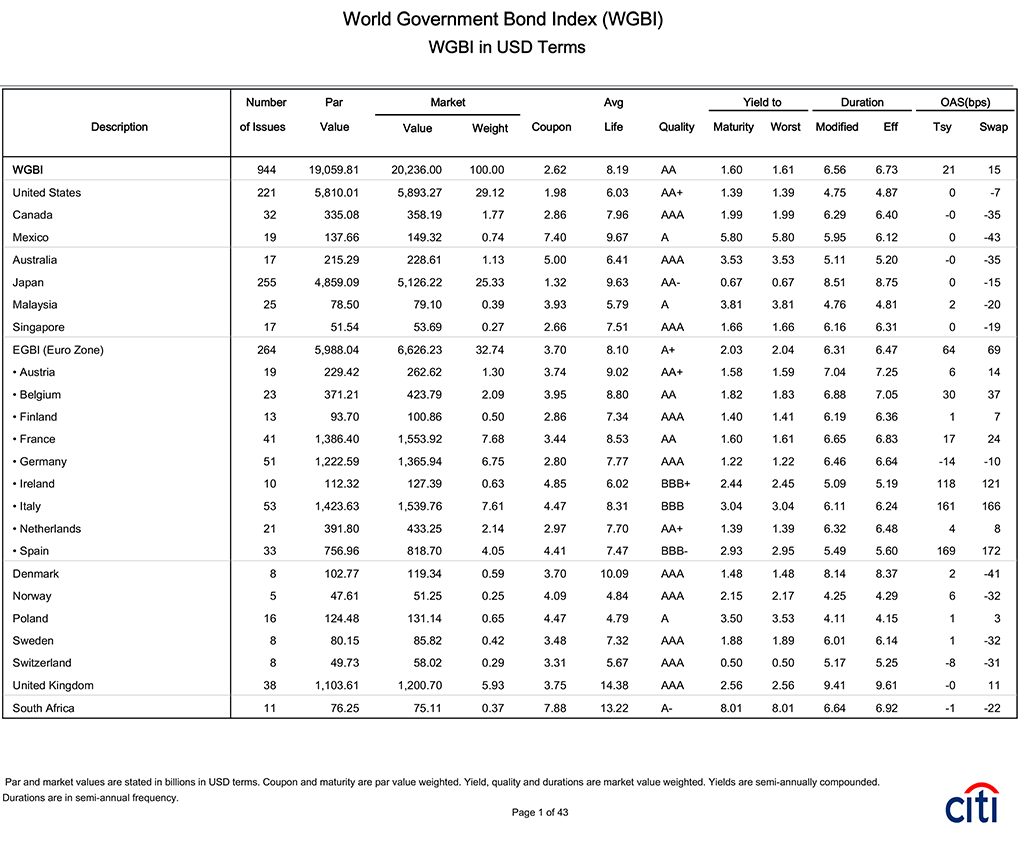

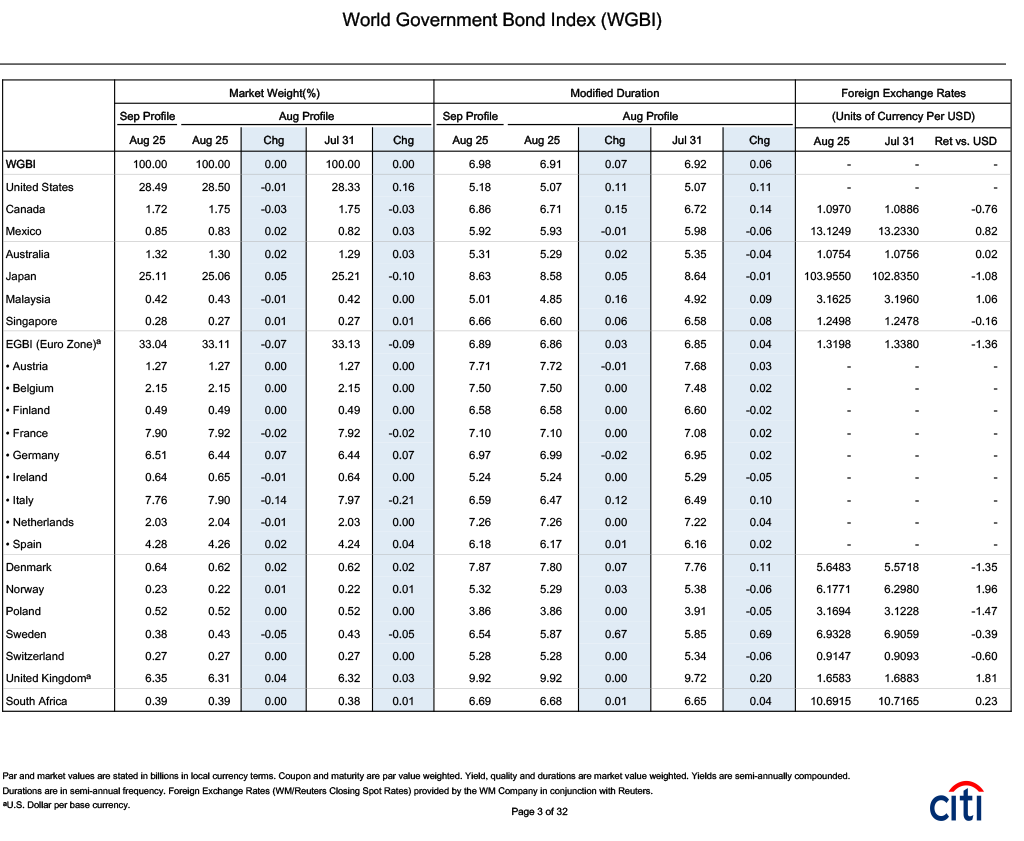

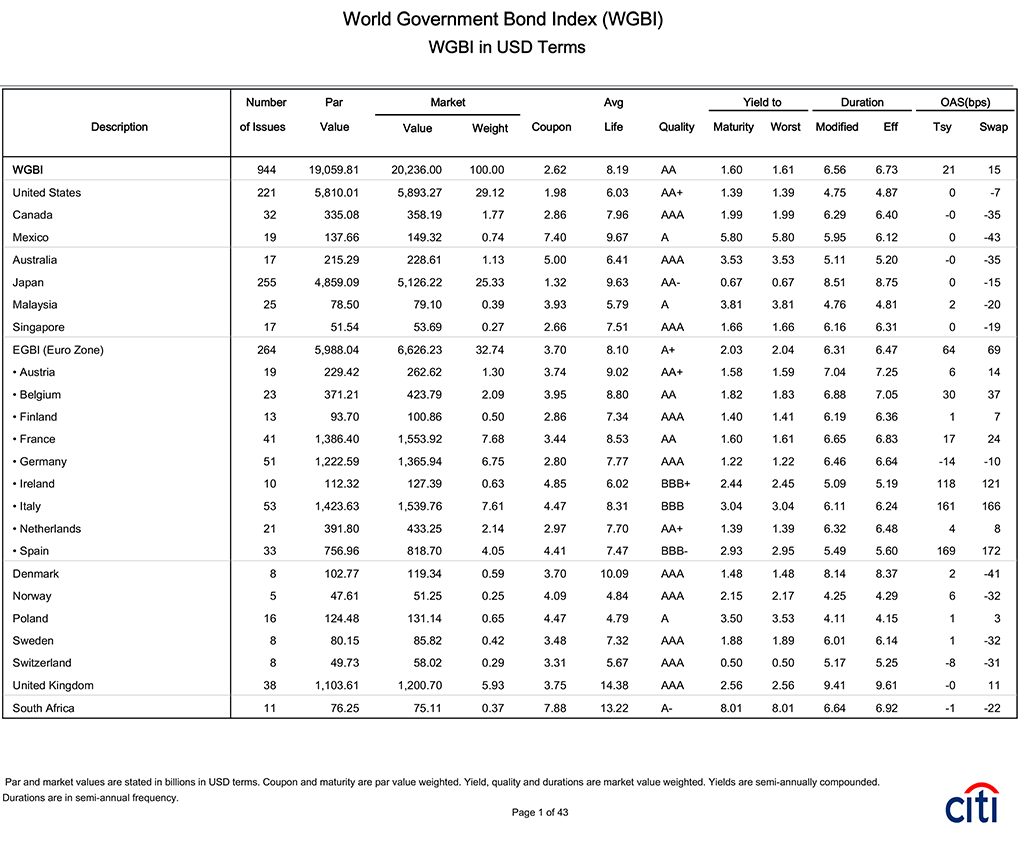

Sector Level - Monthly Profile

This report provides monthly index profile information, at a sector level.

Reported analytics include:

- number of issues

- par value

- market value

- market weight

- coupon

- average life

- credit quality

- different types of yield (e.g. yield-to-maturity, yield-to-worst)

- different measures of duration (e.g. modified duration, effective duration)

- different types of spreads (e.g. OAS to Treasury, OAS to Swap)

×

Sector Level - Monthly Profile

×

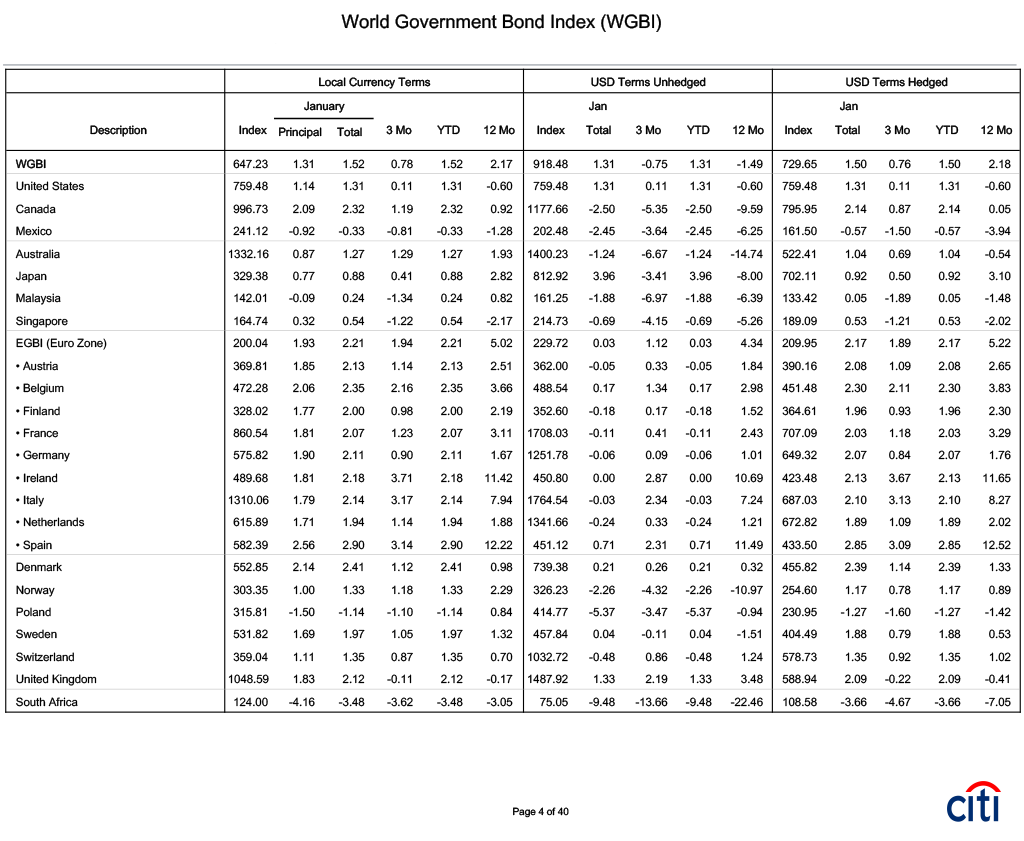

Sector Level - Monthly Returns

This report provides monthly index returns, at a sector level. Returns are provided in local currency terms or in selected currencies (such as USD, EUR, JPY, GBP) hedged or unhedged.

Reported analytics include:

- index level

- monthly returns

- cumulative returns

×

Sector Level - Monthly Returns

×

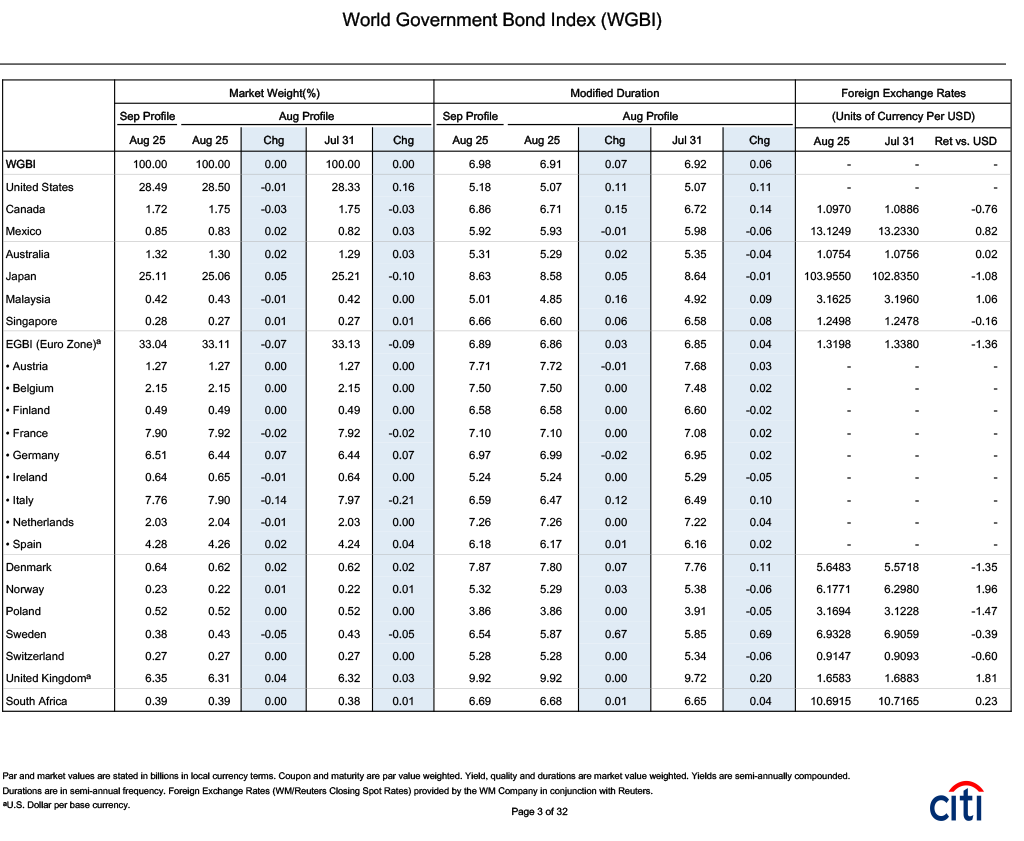

Sector Level - Monthly Profile Fixing

On each monthly index fixing date, publically available information is used to determine index eligibility and indicative values for the following month's index profile. This report is the index's preliminary profile, setting out the anticipated composition of the index.

The purpose of the report is to enable those tracking Citi's fixed income indices to anticipate changes to index composition, providing clarity and time to effect any consequent portfolio rebalancing.

Information, that is provided at a sector level, includes:

- Market weight changes (%) from the previous month-end

- Duration changes from the previous month-end

- Spread changes from previous month-end

- Preliminary index profile for the coming month

A separate report is published on monthly changes, at a constituent level, as a result of the monthly fixing. The report includes securities added, deleted, and changes, such as rating or outstanding amount, along with their their descriptive characteristics (i.e. cusip, ISIN, ticker, coupon, maturity, par amount, currency, industry code classification and credit quality).

×

Sector Level - Monthly Profile Fixing

×

Sector Level - Daily Profile and Returns

This data file provides daily index profile and index return information, at a sector level.

Reported analytics include:

- number of issues

- par value

- market value

- coupon

- average life

- credit quality

- price

- different types of yield (e.g. yield-to-maturity, yield-to-worst)

- different measures of duration (e.g. modified duration, effective duration)

- different types of spreads (e.g. OAS to Treasury, OAS to Swap)

- returns (in local currency terms or in selected currencies such as USD, EUR, JPY, GBP, hedged or unhedged)

×

Issue Level - Monthly Profile

This data file provides basic monthly profile information, at a constituent (issue) level.

Descriptive information provided on each issue includes:

- cusip

- ISIN

- SEDOL

- ticker

- description

- coupon

- maturity date

- country

- currency

- credit quality

- industry classification

- rating sector

- security sector

- index weight

×

Issue Level - Detailed Monthly Profile

This data file provides detailed monthly profile information, at a constituent (issue) level.

Descriptive information on each issue includes all the data that is available in the basic monthly profile report and additionally:

- par amount

- market value

- average life

- accrued interest

- price

- call date

- coupon frequency

- different types of yield (e.g. yield to maturity, yield to worst)

- different measures of duration (e.g. modified duration, effective duration)

- different types of spread (e.g. OAS to treasury, OAS to swap)

- convexity

×

Issue Level - Detailed Monthly Profile and Returns

This data file provides detailed monthly profile and return information, at a constituent (issue) level.

This report supplements the information available on the

detailed monthly profile report with measures of return:

- monthly principle return

- monthly income return

- monthly reinvestment return

- monthly total return

- year-to-date total return

×

Issue Level - Detailed Daily Profile and Returns

This data file provides detailed daily profile and return information, at a constituent (issue) level.

×

Licensing

FTSE's range of fixed income indexes are designed, calculated, and published by FTSE Index and may be licensed

for use as underlying indexes for OTC or exchange-traded derivatives and investment products, including ETFs,

swaps, structured products, warrants, and certificates. Leading financial institutions that issue these

instruments depend on FTSE Fixed Income Indexes for the creation of their index-based investment products.