FTSE Pension Liability Index

The FTSE Pension Liability Index reflects the

discount rate that can be used to value liabilities for GAAP reporting purposes.

Created

in 1994, it is a trusted source for plan sponsors and

actuaries to value defined-benefit pension liabilities in compliance with the SEC's and FASB's

requirements on the establishment of a discount rate.

The index also provides an investment performance benchmark for asset-liability management. By

monitoring the index's returns over time, investors can

gauge changes in the value of pension liabilities.

The FTSE Pension Liability Index is derived from Pension Discount Curve (PDC).

Pension Discount Curve(PDC)

A set of yields on hypothetical AA zero coupon bonds whose maturities range from 6 months up to 30 years. The yields of the PDC are used to discount pension liabilities.

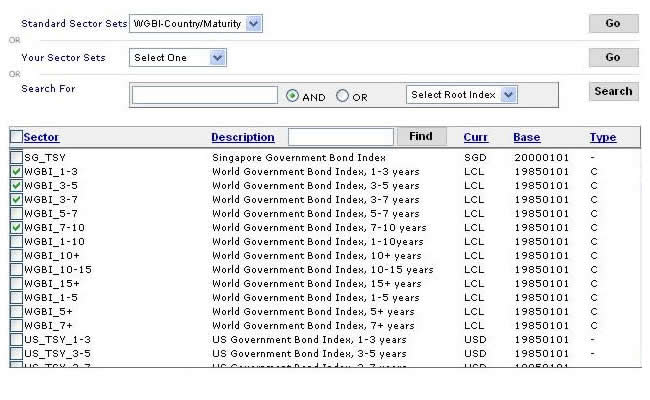

The PDC is calculated based on a universe of AA rated corporate bonds from the FTSE US Broad Investment-Grade Bond Index (USBIG®) and the yields of the Treasury model curve.

Pension Liability Index

The index represents the single discount rate that would produce the same present value as calculated by discounting a standardized set of liabilities using the PDC.

Along with the rate, monthly returns and durations for the index's liabilities are also made available.

You can download the monthly report or download the double-A above median report.

*Daily Report is offered at a fee

- Terms of Use

- Notices and Disclaimers

- Privacy and Cookies Policy

- Global Careers

- Site Map

- www.ftserussell.com

Copyright © 2020 Yield Book Inc.

|

Copyright © 2020 FTSE Fixed Income LLC