Citi Fixed Income Indices

Citi RAFI Bonds Index Series

Citi Fixed Income Indices (Citi) and Research Affiliates have developed a new series of investable bond indices based on the Research Affiliates' Fundamental Index1 (RAFI1) methodology. The Citi RAFI Bonds Index Series includes sovereign and corporate bond indices and uses fundamental measures to weight the index components. The Citi RAFI Bonds Index Series weights index components by the issuer's economic footprint and proxies for ability to service debt. This provides an alternative to market capitalization weighting, where index components are weighted by the issuer's amount of outstanding debt.

| Index Description | |

|---|---|

Citi RAFI Sovereign Developed Markets Bond Index SeriesThis index series seeks to reflect exposure to the government securities of a universe of 23 developed markets. By weighting components by their fundamentals, the indices aim to represent each country's economic footprint and proxies for its ability to service debt. |

Download Fact Sheet Download Rule Book |

Citi RAFI Sovereign Emerging Markets Local Currency Bond Index SeriesThis index series seeks to reflect exposure to the government securities of a universe of 14 emerging markets. By weighting components by their fundamentals, the indices aim to represent each country's economic footprint and ability to service debt. |

Download Fact Sheet Download Rule Book |

Citi RAFI World Corporate Investment-Grade Bond IndexThis index seeks to reflect exposure to global corporate investment-grade securities denominated in AUD, EUR, GBP, JPY and USD. By weighting components by their fundamentals, the index aims to represent each issuer's economic footprint. |

Download Fact Sheet Download Rule Book Download Press Release |

1 Please see important information at the bottom of this page.

Additional Information

-

A Strategic Partnership

Citi brings its expertise and experience in fixed income index related products and services to provide stable and replicable indices.

Research Affiliates brings its research strength, product development capabilities and pioneering proprietary methodology on securities selection and weighting based on fundamental measures.

The Citi RAFI Bonds Index Series is available in Yield Book, Citi's web-based analytical tool that enables clients to manage their portfolios against various indices, analyze portfolio positions, quantify risk and identify drivers of performance.

Citi RAFI Bonds Index SeriesCiti RAFI Sovereign Developed Markets Bond Index SeriesCiti RAFI Sovereign Emerging Markets Local Currency Bond Index SeriesCiti RAFI World Corporate Investment-Grade Bond IndexMasterLiquidMasterLiquidMasterA Strategic Partnership

Citi brings its expertise and experience in fixed income index related products and services to provide stable and replicable indices. Research Affiliates brings its research strength, product development capabilities and pioneering proprietary methodology on securities selection and weighting based on fundamental measures. The Citi RAFI Bonds Index Series is available in Yield Book, Citi's web-based analytical tool that enables clients to manage their portfolios against various indices, analyze portfolio positions, quantify risk and identify drivers of performance.

-

Research Affiliates' Innovative Fundamental Index® Methodology

An alternative approach to securities weighting

Traditional fixed income indices use market capitalization weights which tend to increase exposure to issuers as they become more indebted.

Research Affiliates has developed an innovative methodology for constructing indices which determines component weightings based on fundamental measures.

The essence of this approach is to focus on capturing the economic “footprint” of a sovereign or company, which is correlated with its ability to service its debt

Simultaneously, Research Affiliates' Fundamental Index® methodology preserves the advantages of passive investing:- Diversification

- Liquidity

- Transparency

- Broad economic representation

- Limited transaction costs

Sovereign index methodology

Holdings are weighted based on metrics that signify the importance of a country in the world economy: Population, GDP, Energy consumption, Rescaled land areaCorporate index methodology

Holdings are weighted based on two measures that reflect a company’s debt service capacity: Cash flow and Long-term assets

Note that the Fundamental Index® factors:- are not correlated, or have very low correlation, with market value

- are not affected by investor behavior

- reflect objective measures of relative size

An approach for an inefficient market

Research Affiliates believes that markets are not perfectly efficient and that this inefficiency is particularly evident in the sovereign debt markets.

Why should someone deliberately choose to lend more to entities who are more deeply in debt?

Weighting countries based on their economic fundamentals instead of their outstanding debt moderates exposure to more indebted countries. -

Citi's Expertise in Index Design and Production

A recognized fixed income index provider with more than 30 years of experienceExperience in Indexing

Citi has been producing fixed income indices for more than 30 years. Citi's indices have been widely used in ETFs, structured products and swaps.

Desirable Index Qualities

Indices are governed by objective design criteria, striking a balance between comprehensiveness and replicability. These index qualities are important to active managers, who strive to beat their benchmark, and to passive managers, who strive to minimize tracking error.

Coverage

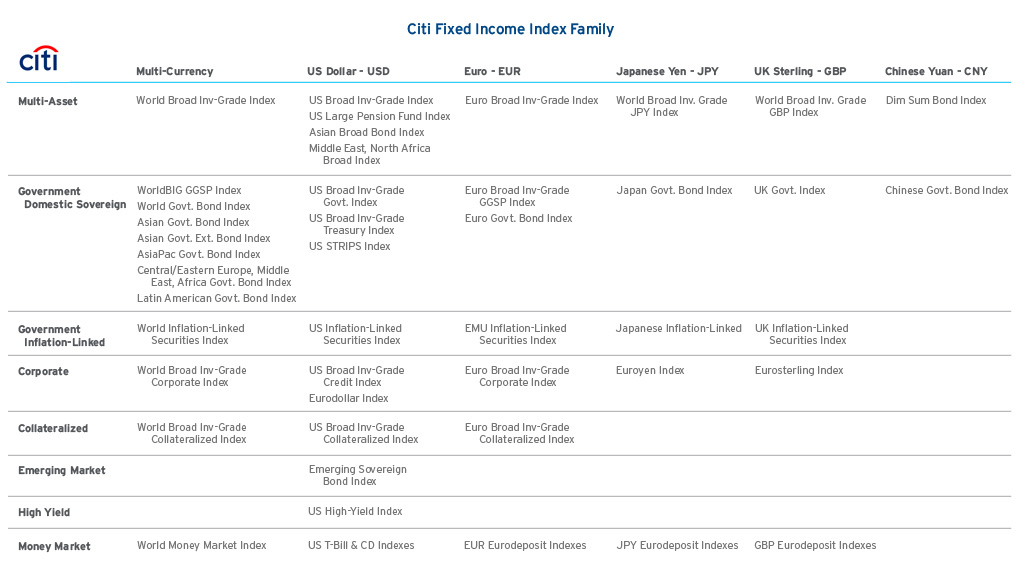

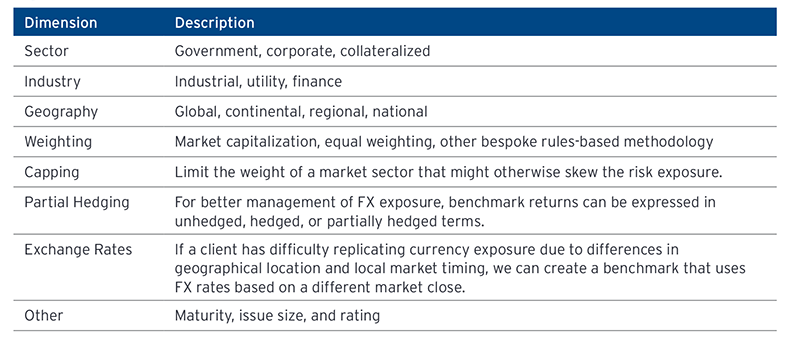

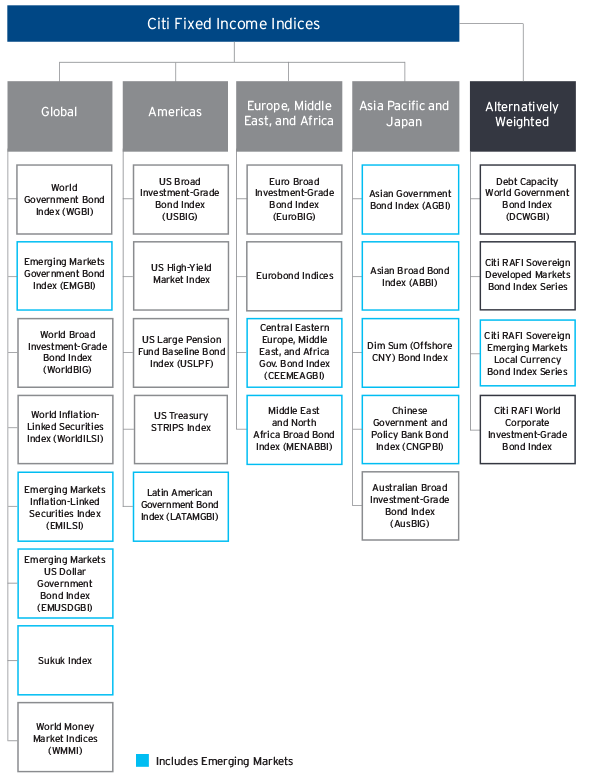

Citi's fixed income indices offer a broad array of currencies, regions, asset classes, and credit qualities.

Fixed Income Analytics

All Citi's fixed income indices are available in Yield Book, Citi's portfolio analytics system for index analysis and risk management.

-

For more information about the Citi RAFI Bonds Index Series, please go to: - • Research Affiliates website: www.researchaffiliates.com

- • Yield Book - Contact Us

Bloomberg - CRFDMU Citi RAFI Sovereign Developed Markets Bond Index Master in USD terms

- CRFDU Citi RAFI Sovereign Developed Markets Bond Index Liquid in USD terms

- CRFELMU Citi RAFI Sovereign Emerging Markets Local Currency Bond Index Master in USD terms

- CRFEMLU Citi RAFI Sovereign Emerging Markets Local Currency Bond Index Liquid in USD terms

- CRFWCIGU Citi RAFI World Corporate Investment-Grade Bond Index in USD terms

NOTICE: The names of the indexes are changing from “Citi [Name of Index]” to “FTSE [Name of Index]”. By July 31, 2018, the transition will be complete and the use of the “Citi” name in the name of the indexes will cease. A full list of the Citi index names and the new FTSE names can be found here.

FTSE Fixed Income LLC and Research Affiliates, LLC have agreed to jointly create and distribute investable fixed income indices (the "Citi RAFI Bonds Index Series") based on Research Affiliates' patented Fundamental Index® methodology. All intellectual property, including trademarks, contributed by Research Affiliates, LLC and FTSE Fixed Income LLC shall remain solely vested with the respective contributor.

As of August 31, 2017 Citi Fixed Income LLC has changed its name to FTSE Fixed Income LLC ("FTSE"). Citi is a trademark and service mark of Citigroup Inc. or its affiliates, is used and registered throughout the world and is used by FTSE under license. The trade names Fundamental Index®, RAFI®, and the Research Affiliates corporate name and logo are the exclusive intellectual property of Research Affiliates, LLC and are registered trademarks in the United States and other countries. Any use of Research Affiliates, LLC's trade names and logos without the prior written permission of Research Affiliates, LLC is expressly prohibited and Research Affiliates, LLC reserves the right to take any and all necessary action to preserve all of its rights, title and interest in and to these marks. Various features of the Fundamental Index® methodology, including an accounting data-based non-capitalization data processing system and method for creating and weighting an index of securities, are protected by various patents, and patent-pending intellectual property of Research Affiliates, LLC. (See all applicable US Patents, Patent Publications, and Patent Pending intellectual property located at http://www.researchaffiliates.com/Pages/legal.aspx#d, which are fully incorporated herein.)

© 2018, FTSE Fixed Income LLC. All rights reserved. © 2018, Research Affiliates, LLC. All rights reserved.

- Terms of Use

- Notices and Disclaimers

- Privacy and Cookies Policy

- Global Careers

- Site Map

- www.ftserussell.com

Copyright © 2020 Yield Book Inc.

|

Copyright © 2020 FTSE Fixed Income LLC

Contact Us

THE AMERICAS

28 Liberty Street

58th Floor

New York, New York 10005

Tel: (646) 989-2200

40 Fountain Plaza

6th Floor

Buffalo, NY 14202

United States

One Market Plaza

Floor 36

San Francisco, CA 94105

United States

EUROPE, MIDDLE EAST, AFRICA

10 Paternoster Square

London EC4M 7LS

United Kingdom

+44 20 7334 8962

ASIA PACIFIC

Suites 3506-3508

35th Floor

Two Exchange Square

8 Connaught Place

Central

Hong Kong

+852 2164 3288

30F, Akasaka BizTower

5-3-1 Akasaka

Minato-ku

Tokyo

107-6330

+81 3 6441 1440

26F NanShan Plaza,

100 Songren Rd., Xinyi Dist.,

Taipei 110, Taiwan

+886 2 8979 4966

*This link navigates to a non Yield Book website

THE AMERICAS

Yield Book

111 Wall Street

14th Floor

New York, New York 10005

Tel: (212) 816-7120

FTSE Russell

40 Fountain Plaza

6th Floor

Buffalo, NY 14202

United States

FTSE Russell

One Market Plaza

Floor 36

San Francisco, CA 94105

United States

EUROPE, MIDDLE EAST, AFRICA

FTSE Russell

10 Paternoster Square

London EC4M 7LS

United Kingdom

+44 20 7334 8962

ASIA PACIFIC

FTSE Russell Hong Kong

Suites 3506-3508

35th Floor

Two Exchange Square

8 Connaught Place

Central

Hong Kong

+852 2164 3288

Yield Book

13th Floor, No 1,

Songzhi Road

Taipei 110, Taiwan

Tel: 886-2-8726-9778

*This link navigates to a non Yield Book website

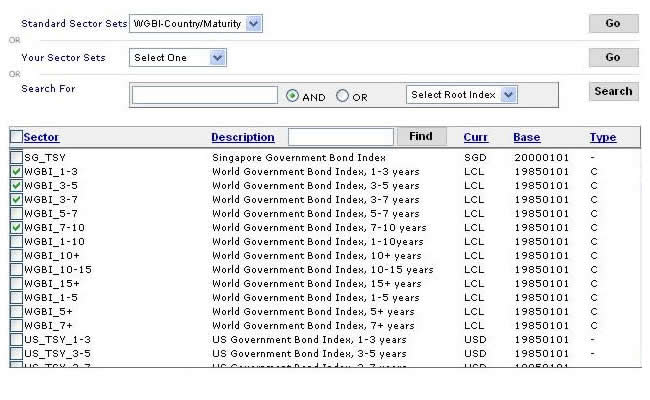

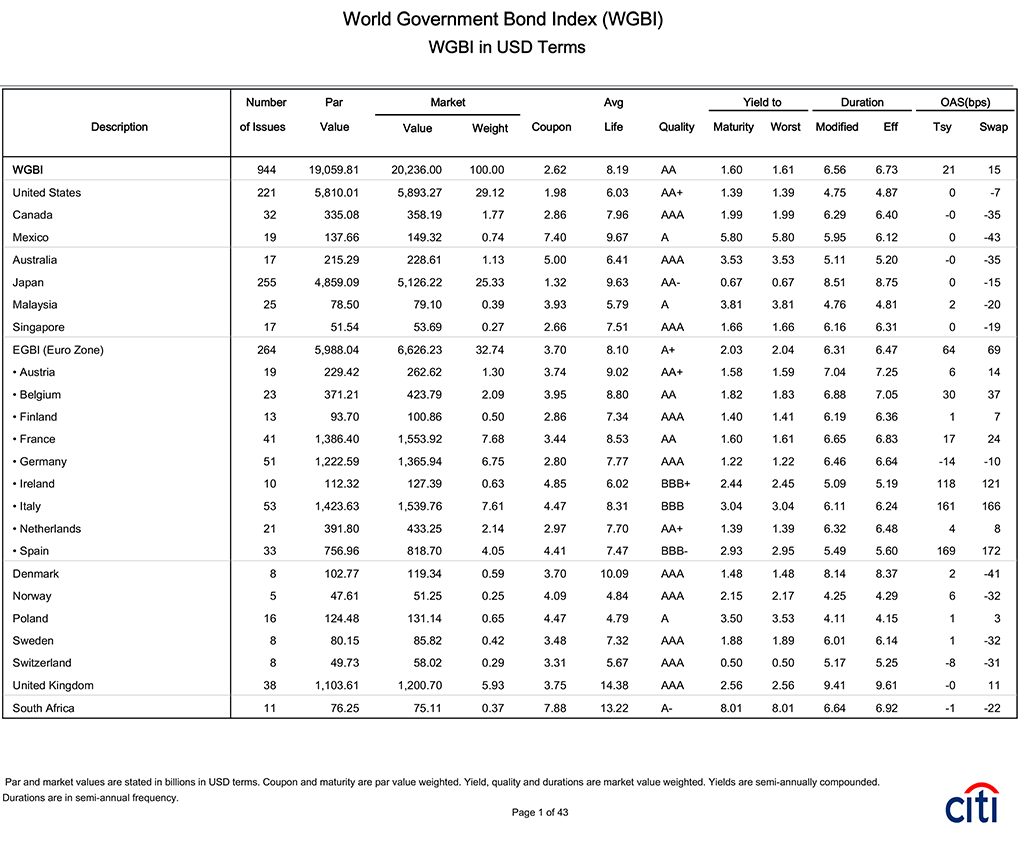

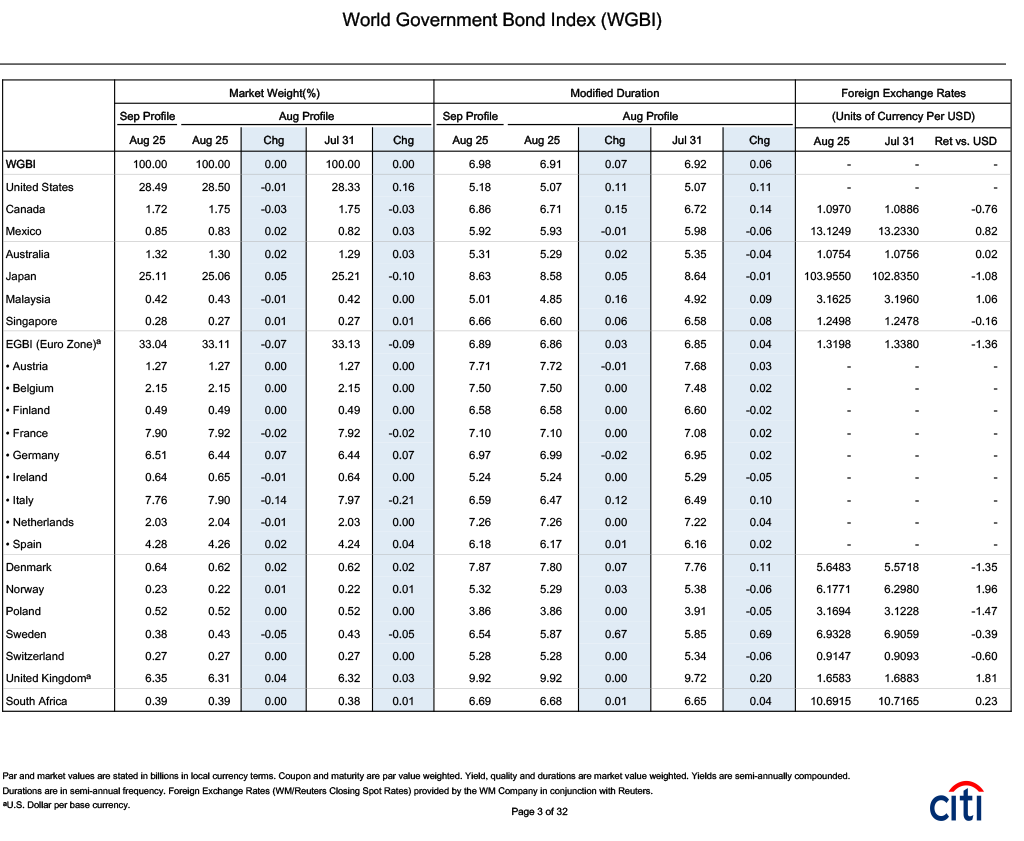

Sector Level - Monthly Profile

This report provides monthly index profile information, at a sector level.

- number of issues

- par value

- market value

- market weight

- coupon

- average life

- credit quality

- different types of yield (e.g. yield-to-maturity, yield-to-worst)

- different measures of duration (e.g. modified duration, effective duration)

- different types of spreads (e.g. OAS to Treasury, OAS to Swap)

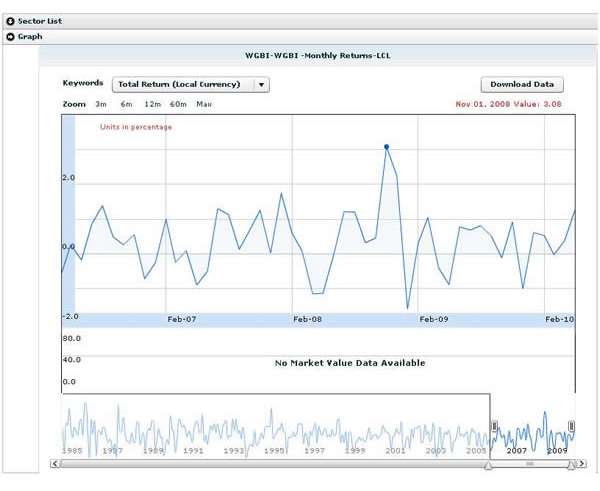

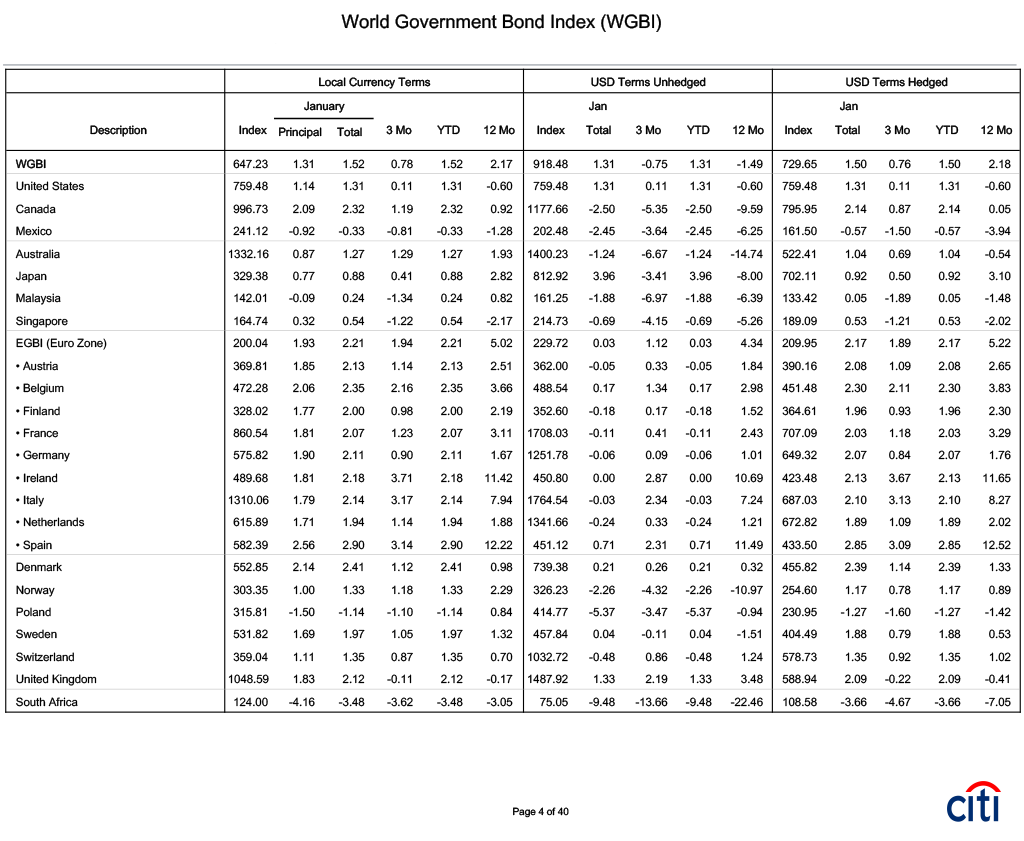

Sector Level - Monthly Returns

This report provides monthly index returns, at a sector level. Returns are provided in local currency terms or in selected currencies (such as USD, EUR, JPY, GBP) hedged or unhedged.

Sector Level - Monthly Profile Fixing

On each monthly index fixing date, publically available information is used to determine index eligibility and indicative values for the following month's index profile. This report is the index's preliminary profile, setting out the anticipated composition of the index.

The purpose of the report is to enable those tracking Citi's fixed income indices to anticipate changes to index composition, providing clarity and time to effect any consequent portfolio rebalancing.

- Market weight changes (%) from the previous month-end

- Duration changes from the previous month-end

- Spread changes from previous month-end

- Preliminary index profile for the coming month

A separate report is published on monthly changes, at a constituent level, as a result of the monthly fixing. The report includes securities added, deleted, and changes, such as rating or outstanding amount, along with their their descriptive characteristics (i.e. cusip, ISIN, ticker, coupon, maturity, par amount, currency, industry code classification and credit quality).

Sector Level - Daily Profile and Returns

This data file provides daily index profile and index return information, at a sector level.

- number of issues

- par value

- market value

- coupon

- average life

- credit quality

- price

- different types of yield (e.g. yield-to-maturity, yield-to-worst)

- different measures of duration (e.g. modified duration, effective duration)

- different types of spreads (e.g. OAS to Treasury, OAS to Swap)

- returns (in local currency terms or in selected currencies such as USD, EUR, JPY, GBP, hedged or unhedged)

Issue Level - Monthly Profile

This data file provides basic monthly profile information, at a constituent (issue) level.

- cusip

- ISIN

- SEDOL

- ticker

- description

- coupon

- maturity date

- country

- currency

- credit quality

- industry classification

- rating sector

- security sector

- index weight

Issue Level - Detailed Monthly Profile

This data file provides detailed monthly profile information, at a constituent (issue) level.

- par amount

- market value

- average life

- accrued interest

- price

- call date

- coupon frequency

- different types of yield (e.g. yield to maturity, yield to worst)

- different measures of duration (e.g. modified duration, effective duration)

- different types of spread (e.g. OAS to treasury, OAS to swap)

- convexity

Issue Level - Detailed Monthly Profile and Returns

This data file provides detailed monthly profile and return information, at a constituent (issue) level.

- monthly principle return

- monthly income return

- monthly reinvestment return

- monthly total return

- year-to-date total return

Issue Level - Detailed Daily Profile and Returns

This data file provides detailed daily profile and return information, at a constituent (issue) level.

Additionally, it includes daily total returns on each issue.

Licensing

FTSE's range of fixed income indexes are designed, calculated, and published by FTSE Index and may be licensed for use as underlying indexes for OTC or exchange-traded derivatives and investment products, including ETFs, swaps, structured products, warrants, and certificates. Leading financial institutions that issue these instruments depend on FTSE Fixed Income Indexes for the creation of their index-based investment products.